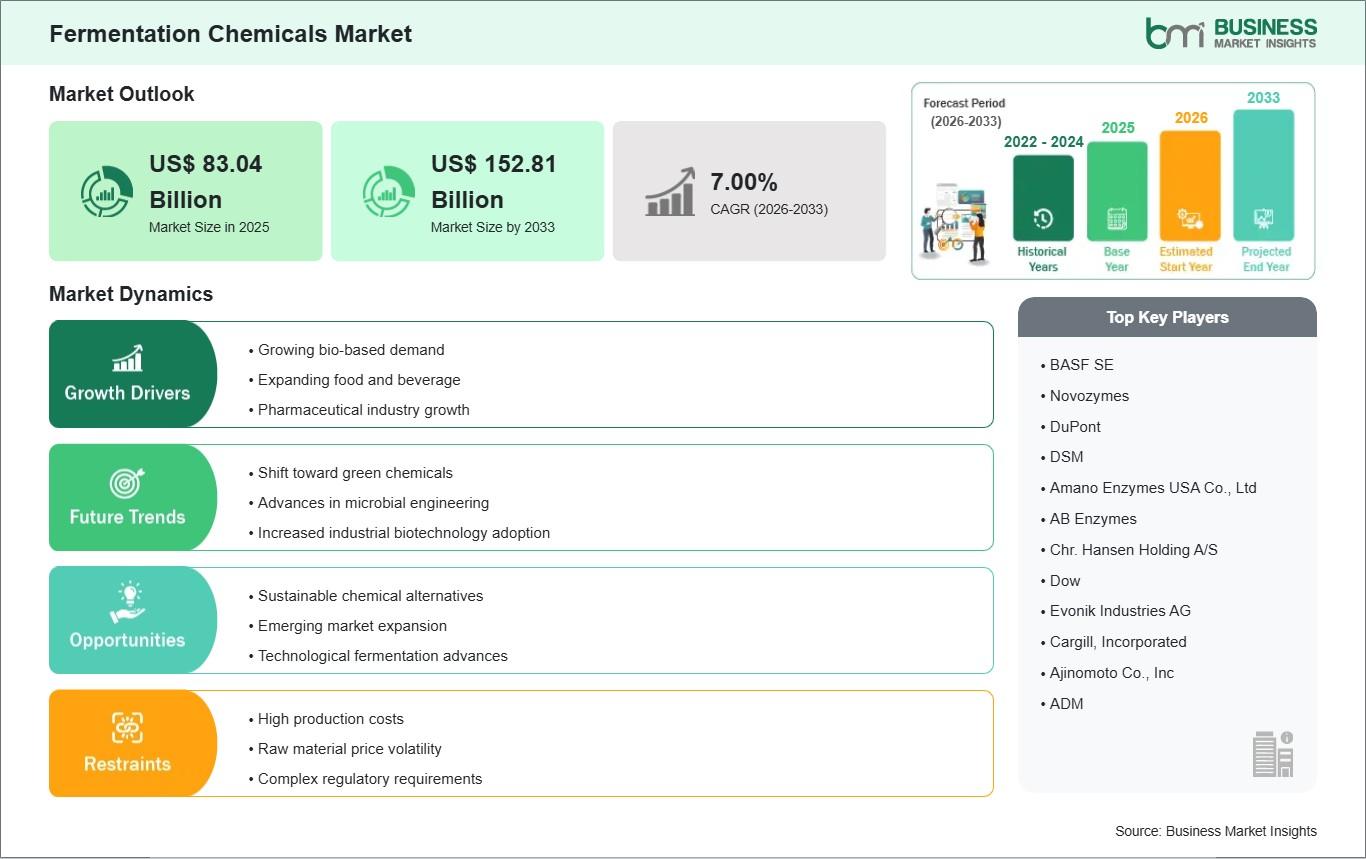

According to Th e Business Market Insights The Global Fermentation Chemicals Market is poised for substantial expansion, projected to surge from US$ 83.04 billion in 2025 to US$ 152.81 billion by 2033, recording a robust compound annual growth rate (CAGR) of 7.0% from 2026 to 2033. This growth underscores the rising demand for sustainable, bio-based chemicals across industries like food & beverages, pharmaceuticals, and biofuels, driven by consumer preferences for eco-friendly alternatives and advancements in biotechnology. As industries shift from petrochemicals to renewable sources, fermentation chemicals—produced via microbial processes—are emerging as key enablers of green innovation.

Download Sample Report - https://www.businessmarketinsights.com/sample/BMIPUB00032543

Market Overview

Fermentation chemicals encompass organic acids, alcohols, enzymes, amino acids, and vitamins derived from microorganisms breaking down sugars and starches anaerobically. Valued at approximately US$ 80-83 billion in recent years, the market reflects strong momentum fueled by sustainability mandates and health trends. Key products include citric acid for food preservation, lactic acid for bioplastics, and ethanol for biofuels, with alcohols dominating over 57% market share due to their versatility in beverages and industrial solvents.

Industrial applications lead with over 43% share, powering biofuels, detergents, and solvents, while food & beverages and nutritional/pharmaceutical segments grow fastest amid rising processed food demand and chronic disease prevalence. North America holds the largest regional share at around 37%, bolstered by pharmaceutical strength and cosmetic innovations, whereas Asia-Pacific exhibits the highest CAGR, propelled by industrialization in China and India.

Growth Drivers

Surging demand for bio-based products tops the drivers, as governments and firms prioritize low-carbon alternatives amid global net-zero goals. The food & beverage sector, boosted by fermented staples like yogurt, beer, and sauerkraut, benefits from enhanced flavor, nutrition, and shelf life, with global wine production alone hitting 258 million hectoliters. Pharmaceuticals rely on these chemicals for antibiotics, vaccines, and vitamins, with WHO projecting cancer cases to rise from 20 million in 2024 to 30 million by 2040, spurring therapeutic needs.

Biofuel expansion adds momentum, with IEA noting 6% production growth to 2.1 million barrels/day in 2023, set for 38% rise by 2028 via ethanol fermentation. Technological leaps like CRISPR-Cas9 gene editing and bioreactor optimizations boost yields and scalability, enabling precision fermentation for high-value outputs.

Key Trends and Innovations

Sustainability dominates trends, with vegan/natural foods and biodegradable plastics driving organic acid demand like lactic and citric acids. Precision fermentation enhances efficiency, yielding specialty enzymes for detergents and feed, while synthetic biology crafts carbon-negative chemicals from plant feedstocks. Recent moves include ADM-Solugen's 2023 plant-based specialty chemicals partnership and Novozymes' 2022 Innova® Apex for faster ethanol production.

Asia-Pacific's food startups and Europe's regulatory push for bio-chemicals amplify adoption, with investments like Nestle's USD 675 million oat milk facility signaling plant-based surges.

Trending Keywords –

- Cosmetic Chemicals Market - Outlook (2022-2033)

- Rubber Processing Chemicals Market - Outlook (2022-2033)

- Specialty Chemicals Market - Outlook (2022-2033)

Major Players

Leading firms shape the landscape through R&D and expansions:

- BASF SE: World's largest chemical producer; expanded enzyme capacity in Ludwigshafen, Germany, in 2022.

- Evonik Industries AG: Launched animal-free "Vecollan" collagen via fermentation in 2022.

- Cargill, Inc.: Key in organic acids and ethanol for food/industrial uses.

- Archer-Daniels-Midland (ADM): Partners on bio-based molecules for cleaning and energy.

- Ajinomoto Co., Inc., DuPont de Nemours, Novozymes A/S, DSM-Firmenich: Innovate in amino acids, enzymes, and biopharma.

These players focus on sustainable portfolios, mergers, and biotech to capture the 7.0% CAGR trajectory.

Regional Insights

North America dominates with 34-37% share, driven by U.S. pharma and F&B demand. Asia-Pacific grows fastest at ~6.9% CAGR, led by China's solvents research and India's alcohol/pharma sectors. Europe advances via green regulations, Latin America via Brazil's biofuels, and MENA via diversification.

Challenges and Opportunities

High production costs, feedstock volatility (sugarcane/corn), and regulatory hurdles like FDA GMP standards restrain growth. Yet, opportunities abound in novel techniques, vegan products, and emerging markets, with bio-based shifts promising greener futures.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.