Market Outlook

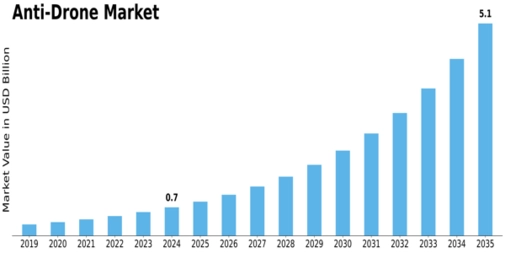

The Anti-Drone Market, estimated at USD 0.55 billion in 2023, is projected to grow to nearly USD 2.62 billion by 2032, posting a robust CAGR of around 25 % over the forecast period. This growth is driven by heightened drone usage, elevated threat awareness and improved counter-UAV system affordability.

Industry Overview

Today’s drone environment is complex. Commercial drones perform vital roles in infrastructure inspection, photography, agriculture and logistics—but the same platforms can be repurposed for intrusion, espionage or disruption. Government and enterprise customers are mobilising to thwart unauthorised drone activity around airports, prisons, utility sites and sensitive installations. Anti-drone systems therefore combine detection (sensing, classification) with interdiction (signal disruption, laser, take-down). This dual-capability approach is integral to maintaining safe airspace and securing high-value targets.

Key Players Role

In the competitive landscape, firms such as SRC, Inc. (US), Liteye Systems, Inc. (US), DroneShield Ltd. (Australia), and Rafael Advanced Defense Systems Ltd. (Israel) are prominent. They invest in product innovation—from portable jammers to integrated radar-laser platforms—and pursue strategic collaborations and contracts with defence and civil agencies. Their efforts help bring down overall cost, increase deployment scale and widen adoption to non-military markets.

Segmentation Growth

Breakdown of market segments reveals where demand is accumulating:

-

Detection (Application): Radar remains the largest detection segment, owing to its wide-area surveillance capability. Others—EO/IR sensors and acoustic devices—serve more targeted applications like indoor detection or low-altitude flight.

-

Interdiction (Neutralisation): Jammers lead today, thanks to mature technology and cost-efficiency. But lasers and other advanced neutralisation methods are gaining traction, especially in defence use-cases.

-

Platform: Ground-based systems account for the highest share. Handheld and UAV-based counter-drone systems are growing as the need for mobile, rapid-deployment solutions increases.

-

End-User: Defence remains the major end-user given security imperatives, yet commercial adoption is increasing in sectors such as aviation, utilities, logistics and event security.

Conclusion

As the drone ecosystem grows, so too does the requirement for effective counter-measures. The anti-drone market is therefore highly relevant—and expanding rapidly. Organisations looking to secure airspace must evaluate detection and neutralisation technologies, align with qualified system providers and stay alert to evolving threats. For vendors, focusing on modular, scalable solutions and expanding beyond defence into commercial realms presents a substantial opportunity.