Market Overview

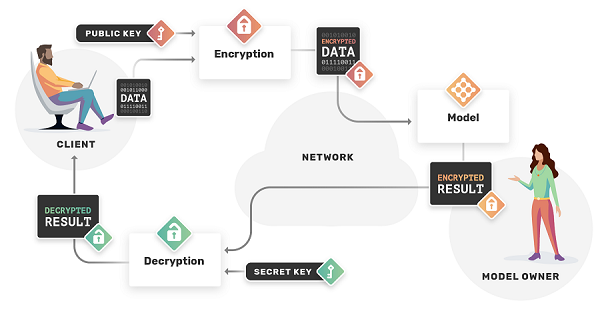

The Homomorphic Encryption Market is witnessing rapid growth as enterprises increasingly prioritize data privacy and secure computation in the cloud. Homomorphic encryption enables computation on encrypted data without the need for decryption, ensuring that sensitive information remains secure throughout the data lifecycle. This technology addresses the growing global concerns over cybersecurity, data breaches, and privacy compliance—especially in sectors such as banking, healthcare, government, and cloud services. The increasing adoption of cloud computing and artificial intelligence (AI) has led to the generation of vast amounts of sensitive data, requiring advanced encryption methods that do not compromise performance or usability. Moreover, compliance with data protection regulations like GDPR, HIPAA, and CCPA is accelerating the deployment of homomorphic encryption solutions. As organizations embrace digital transformation, homomorphic encryption is becoming a key enabler of secure, privacy-preserving analytics and collaborative data sharing.

Market Key Players

The homomorphic encryption market features a growing number of technology innovators, academic researchers, and cybersecurity companies driving product development and standardization. Key players in the market include Microsoft Corporation, IBM Corporation, Google LLC, Intel Corporation, Duality Technologies, CryptoExperts, Enveil Inc., Thales Group, ShieldIO, and Huawei Technologies Co., Ltd. These companies are focusing on improving computational efficiency, developing open-source frameworks, and integrating homomorphic encryption into existing security architectures. IBM and Microsoft have been at the forefront of developing fully homomorphic encryption (FHE) tools that can be integrated into AI and cloud systems. Duality Technologies and Enveil, on the other hand, are pioneers in privacy-enhancing technologies for enterprise and government applications. Continuous research and collaboration between tech giants and academic institutions such as MIT and Stanford University are further driving innovation, making the technology more practical for real-world use.

Market Segmentation

The homomorphic encryption market can be segmented based on type, application, organization size, and industry vertical. By type, the market is divided into partial, somewhat, and fully homomorphic encryption (FHE). Fully homomorphic encryption is the most advanced form, allowing unlimited mathematical operations on ciphertexts, though it currently faces challenges in computational speed. By application, the technology is used in secure data analytics, cloud computing, machine learning, and blockchain. Based on organization size, the market is segmented into small and medium-sized enterprises (SMEs) and large enterprises, with large corporations currently leading adoption due to higher cybersecurity budgets. In terms of industry verticals, the key sectors include banking, financial services and insurance (BFSI), healthcare, IT and telecom, government and defense, and manufacturing. The BFSI sector dominates the market due to stringent regulatory frameworks and the need for secure customer data handling, while healthcare organizations are adopting encryption to ensure secure patient data sharing.

Market Drivers

Several factors are driving the expansion of the homomorphic encryption market, with data privacy concerns and cloud adoption at the forefront. As enterprises increasingly rely on third-party cloud services, maintaining control over sensitive data becomes crucial. Homomorphic encryption enables encrypted computation in the cloud, allowing data owners to utilize cloud resources without compromising security. The rise in cyberattacks, data breaches, and identity theft has also prompted organizations to invest in next-generation encryption methods. Additionally, the growing use of AI and machine learning models that rely on large-scale data processing is creating demand for privacy-preserving computation techniques. Another major driver is the global regulatory environment, which mandates compliance with data protection laws, encouraging organizations to implement advanced encryption to safeguard user information. The ongoing digital transformation across sectors and the shift toward decentralized data architectures are also pushing the market toward rapid adoption.

Market Opportunities

The homomorphic encryption market presents significant opportunities for innovation and commercialization as industries look to harness the power of encrypted computation. The rise of edge computing, Internet of Things (IoT) devices, and secure cloud analytics offers a fertile landscape for applying homomorphic encryption technologies. Governments and financial institutions are exploring the use of FHE for confidential transactions, fraud detection, and secure data sharing across networks. Additionally, the growing adoption of multi-party computation (MPC) and zero-knowledge proofs is creating complementary opportunities for homomorphic encryption integration. Startups and research institutions are focusing on enhancing the speed and efficiency of encryption algorithms to make them viable for commercial-scale operations. The market also holds potential for collaboration with blockchain platforms, enabling privacy-preserving smart contracts and secure decentralized applications (dApps). Furthermore, the integration of homomorphic encryption into AI training processes allows businesses to develop models using sensitive data without exposing the underlying information, creating massive opportunities in healthcare, finance, and cybersecurity analytics.

Regional Analysis

The global homomorphic encryption market is geographically segmented into North America, Europe, Asia-Pacific, the Middle East & Africa, and South America, each showing unique growth trends. North America currently leads the market due to strong technological infrastructure, early adoption of privacy-enhancing technologies, and significant R&D investments by key players like IBM, Microsoft, and Google. The U.S. government’s focus on data security in critical sectors such as defense, finance, and healthcare further supports market growth. Europe follows closely, driven by strict data protection regulations like GDPR and a growing emphasis on digital sovereignty. Countries such as Germany, the U.K., and France are investing in academic and industrial research in cryptography. The Asia-Pacific (APAC) region is expected to witness the fastest growth, led by countries such as China, Japan, South Korea, and India, where digital transformation and cloud adoption are accelerating. The growing tech ecosystem and expansion of AI-driven industries are contributing to increased adoption in the region. Middle East and Africa (MEA) and South America are gradually emerging markets, focusing on cybersecurity modernization and compliance with evolving privacy laws.

Industry Updates

Recent developments in the homomorphic encryption industry indicate strong momentum toward commercial deployment and standardization. In 2024, the Homomorphic Encryption Standardization (HES) Consortium, involving leading tech firms and research groups, advanced efforts to establish uniform performance benchmarks and interoperability standards. IBM and Microsoft announced improvements in their open-source FHE libraries, significantly reducing computation latency and resource consumption. Startups such as Duality Technologies and Zama introduced privacy-preserving machine learning frameworks that enable encrypted model training and inference. Additionally, collaborations between government agencies and private enterprises are accelerating the adoption of secure data computation tools for defense and intelligence applications. In the healthcare domain, organizations are testing FHE-based solutions to perform genome analysis and patient data analytics securely in the cloud. Venture capital investment in homomorphic encryption startups is also increasing, signaling growing commercial interest and market maturity. With continuous innovation, the industry is moving closer to making FHE an integral part of enterprise-grade cybersecurity solutions.