"Executive Summary ATM Outsourcing Services Market Size, Share, and Competitive Landscape

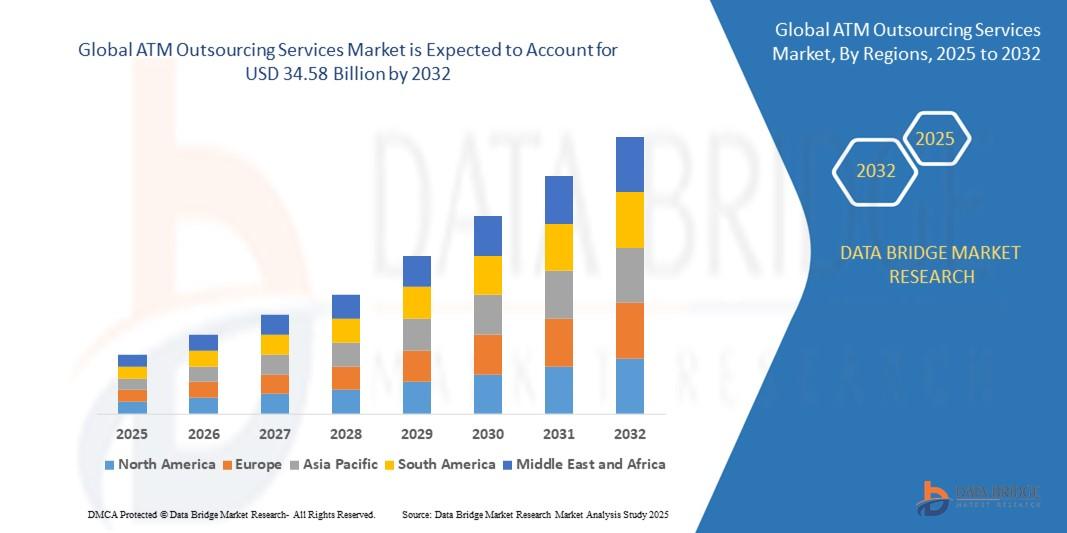

- The global ATM outsourcing services market size was valued at USD 21.53 billion in 2024 and is expected to reach USD 34.58 billion by 2032, at a CAGR of 6.10% during the forecast period

To attain knowhow of market landscape, brand awareness, latest trends, possible future issues, industry trends and customer behavior, the finest ATM Outsourcing Services Market research report is very crucial. The report also identifies and analyses the intensifying trends along with major drivers, challenges and opportunities in the market. This market report is a source of information about ATM Outsourcing Services Market industry which puts forth current and upcoming technical and financial details of the industry to 2029. Global ATM Outsourcing Services Market business report has been formed with the appropriate expertises that utilize established and unswerving tools and techniques such as SWOT analysis and Porter's Five Forces analysis to conduct the research study.

The high quality ATM Outsourcing Services Market business report encompasses a range of inhibitors as well as driving forces of the market which are analysed in both qualitative and quantitative manner so that readers and users get precise information and insights. All the data and statistics covered in this report are backed up by latest and proven tools and techniques such as SWOT analysis and Porter's Five Forces Analysis. For in depth perceptive of market and competitive landscape, the report serves a lot of parameters and detailed data. The universal ATM Outsourcing Services Market report is prepared by performing high level market research analysis of key marketplace segments to identify opportunities, challenges, drivers, and market structures for the clients.

See what’s driving the ATM Outsourcing Services Market forward. Get the full research report:

https://www.databridgemarketresearch.com/reports/global-atm-outsourcing-services-market

ATM Outsourcing Services Industry Landscape

Segments

- Based on ATM service type, the Global ATM Outsourcing Services Market can be segmented into onsite ATM and offsite ATM. The onsite ATM segment is expected to dominate the market due to the increasing demand for convenient and accessible services. Onsite ATMs are typically located within a branch or a retail location, providing customers with easy access to cash withdrawal and other banking services. Offsite ATMs, on the other hand, are usually found in standalone locations such as shopping malls, airports, and convenience stores.

- Geographically, the Global ATM Outsourcing Services Market can be segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is projected to hold a significant share in the market, attributed to the high adoption rate of advanced banking technologies and the presence of key market players in the region. Asia-Pacific is also forecasted to witness substantial growth due to the increasing number of banking facilities and the rising trend of digital banking services in countries like China and India.

- By type of deployment, the market can be categorized into onsite ATM outsourcing and offsite ATM outsourcing. Onsite ATM outsourcing is set to witness robust growth as banks and financial institutions look to streamline their operations and focus on core competencies, leading them to outsource ATM management and maintenance services. Offsite ATM outsourcing is also expected to experience steady growth driven by the need for cost-effective solutions and enhanced customer service.

Market Players

- Some of the key players operating in the Global ATM Outsourcing Services Market include Diebold Nixdorf, NCR Corporation, Cardtronics, FIS, Euronet Worldwide, Cash Transactions, Asseco, Burroughs, Avery Scott, and Sharenet. These market players are actively engaged in partnerships, acquisitions, and product innovations to strengthen their market presence and cater to the evolving needs of financial institutions and consumers in the ATM outsourcing services sector.

For more information, visit: The Global ATM Outsourcing Services Market continues to witness significant growth and evolution driven by various segmentation factors. One emerging segment is the differentiation based on ATM service type, distinguishing between onsite ATM and offsite ATM services. The onsite ATM segment is poised to maintain dominance in the market due to the increasing consumer preference for convenient and easily accessible banking services. Onsite ATMs, situated within branches or retail locations, offer customers seamless access to cash withdrawal and other vital banking services, enhancing overall customer experience and satisfaction. In contrast, offsite ATMs, located in standalone areas like shopping malls or airports, provide additional flexibility and convenience but may not attract as high a volume of transactions as their onsite counterparts.

Moreover, geographical segmentation plays a crucial role in mapping the Global ATM Outsourcing Services Market landscape. Regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa exhibit varying levels of market maturity and growth potential. North America stands out as a key market player, supported by the rapid adoption of advanced banking technologies and a robust presence of established industry leaders. Meanwhile, Asia-Pacific showcases promising growth prospects fueled by the expanding network of banking facilities and the accelerating shift towards digital banking services, particularly in emerging economies like China and India.

Furthermore, the market segmentation based on the type of deployment, namely onsite ATM outsourcing and offsite ATM outsourcing, underscores the strategic decisions adopted by banks and financial institutions to streamline operations and enhance customer service offerings. Onsite ATM outsourcing is anticipated to experience strong growth momentum as organizations prioritize core competencies and efficiency by outsourcing ATM management and maintenance functions. Simultaneously, offsite ATM outsourcing is forecasted to witness steady growth, driven by the quest for cost-effective solutions and elevated customer service standards across various ATM locations.

In terms of market players, a competitive landscape emerges with key industry participants such as Diebold Nixdorf, NCR Corporation, Cardtronics, FIS, Euronet Worldwide, Cash Transactions, Asseco, Burroughs, Avery Scott, and Sharenet actively shaping the market dynamics through strategic partnerships, acquisitions, and product innovations. These market leaders continuously strive to bolster their market positions, leverage technological advancements, and cater to the evolving needs of financial institutions and consumers within the dynamic ATM outsourcing services sector.

In conclusion, the Global ATM Outsourcing Services Market is characterized by a multifaceted landscape defined by various segmentation criteria, regional dynamics, and competitive strategies adopted by key market players. The market's trajectory remains optimistic, driven by shifting consumer preferences, technological advancements, and the strategic initiatives undertaken by industry stakeholders to navigate the evolving financial services landscape.

For comprehensive market insights, the link provided can be referenced: The Global ATM Outsourcing Services Market is witnessing a transformative shift driven by evolving consumer demands and technological advancements that are reshaping the industry landscape. An emerging trend within the market is the segmentation based on ATM service type, highlighting the distinction between onsite ATM and offsite ATM services. The dominance of the onsite ATM segment is expected to persist due to the growing consumer preference for convenient and easily accessible banking services provided within branch or retail locations. These onsite ATMs offer a seamless banking experience, facilitating cash withdrawals and other essential services, thereby enhancing overall customer satisfaction. In contrast, offsite ATMs, while offering additional convenience in standalone locations like shopping malls and airports, may face challenges in attracting high transaction volumes compared to their onsite counterparts.

Geographically, the market segmentation plays a critical role in defining the growth trajectory of the Global ATM Outsourcing Services Market. North America is positioned as a key market player, driven by the rapid adoption of advanced banking technologies and a strong presence of established industry leaders in the region. Concurrently, Asia-Pacific presents promising growth opportunities fueled by the expanding network of banking facilities and the accelerating shift towards digital banking services, particularly in emerging economies such as China and India.

Furthermore, the segmentation based on deployment type, namely onsite ATM outsourcing and offsite ATM outsourcing, reflects strategic decisions by banks and financial institutions to optimize operations and enhance customer service offerings. Onsite ATM outsourcing is poised for robust growth as organizations prioritize operational efficiency by outsourcing ATM management and maintenance functions. Meanwhile, offsite ATM outsourcing is anticipated to witness steady growth, driven by the demand for cost-effective solutions and elevated customer service standards across diverse ATM locations.

The competitive landscape of the Global ATM Outsourcing Services Market is characterized by key industry players such as Diebold Nixdorf, NCR Corporation, Cardtronics, FIS, Euronet Worldwide, Cash Transactions, Asseco, Burroughs, Avery Scott, and Sharenet actively shaping the market dynamics through strategic partnerships, acquisitions, and product innovations. These market leaders are focused on strengthening their market positions, leveraging technological advancements, and addressing the evolving needs of financial institutions and consumers within the dynamic ATM outsourcing services sector.

In conclusion, the Global ATM Outsourcing Services Market is poised for continued growth and evolution, driven by changing consumer preferences, technological innovations, and strategic initiatives undertaken by industry stakeholders. The market's future outlook remains optimistic, with opportunities for market players to capitalize on emerging trends and advancements in the financial services sector. For a comprehensive understanding of the market landscape, further exploration of the provided link can offer valuable insights into the evolving dynamics of the Global ATM Outsourcing Services Market.

Review the company’s share in the market landscape

https://www.databridgemarketresearch.com/reports/global-atm-outsourcing-services-market/companies

ATM Outsourcing Services Market – Analyst-Ready Question Batches

- What regulatory frameworks govern this ATM Outsourcing Services Market industry?

- What proportion of sales come from promotions or discounts?

- What is the average shelf life of the ATM Outsourcing Services Market product?

- How important is personalization in this ATM Outsourcing Services Market?

- What are the trends in user-generated content for ATM Outsourcing Services Market?

- What is the average profit margin per unit?

- What’s the demand trend across income groups?

- What portion of sales comes from Tier II & III cities?

- Which retailers dominate product placement?

- What’s the average customer acquisition cost for ATM Outsourcing Services Market?

- What new market segments are emerging?

- What are the effects of digital transformation?

- Which trends are influenced by Gen Z consumers?

- What are the implications of the circular economy for ATM Outsourcing Services Market?

Browse More Reports:

XYZ

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"