Executive Summary Risk Management Software Market Size and Share Forecast

CAGR Value

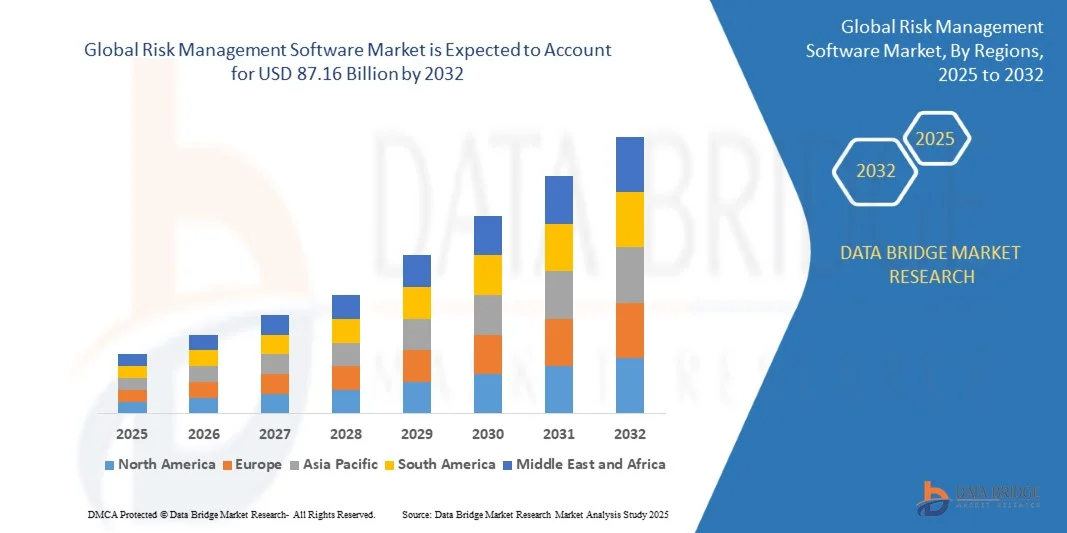

- The Risk Management Software Market size was valued at USD 41.40 billion in 2024 and is projected to reach USD 87.16 billion by 2032, growing at a CAGR of 9.75% during the forecast period.

This Risk Management Software Market research report is a great resource that makes available current as well as upcoming technical and financial details of the Risk Management Software Market industry for the forecast period. A market research report is truly a backbone for every business that wishes to prosper in the market. The report displays current and future market trends and carries out analysis of the influence of buyers, substitutes, new entrants, competitors, and suppliers on the market. Furthermore, the data, facts, and figures collected to generate this Risk Management Software Market report are obtained from trustworthy sources such as websites, journals, mergers, newspapers, and other authentic sources.

What is more, emerging product trends, major drivers, challenges, and opportunities in the market are evaluated exactly while generating this Risk Management Software Market report. A few of the key factors underlined in this market report are market definition, market segmentation, competitive analysis, and research methodology. Because businesses can accomplish great benefits with the different segments covered in the market research report, every bit of the market that can be included here is touched vigilantly. The Risk Management Software report is generated with the systematic gathering and analysis of information about individuals or organizations, which is carried out through social and opinion research.

Gain clarity on industry shifts, growth areas, and forecasts in our Risk Management Software Market report. Get your copy:

https://www.databridgemarketresearch.com/reports/global-risk-management-software-market

Risk Management Software Market Review

Segments

- By Component: The global risk management software market can be segmented by component into software and services. The software segment is expected to dominate the market due to the increasing demand for advanced risk management solutions. The services segment, including consulting services, implementation services, and support and maintenance services, is also witnessing growth as organizations seek assistance in optimizing their risk management processes.

- By Deployment Mode: On the basis of deployment mode, the market can be categorized into cloud-based and on-premises solutions. Cloud-based risk management software is gaining popularity among organizations for its scalability, cost-effectiveness, and ease of access. On-premises solutions, although traditional, still cater to enterprises with stringent data security and compliance requirements.

- By Organization Size: The market can also be segmented by organization size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting risk management software to streamline their processes and enhance decision-making. Large enterprises, on the other hand, are investing in advanced solutions to manage complex risk scenarios across multiple business units and geographies.

- By Vertical: In terms of verticals, the global risk management software market caters to various industries such as banking, financial services, and insurance (BFSI), healthcare, IT and telecom, manufacturing, retail, and others. Each industry vertical has unique risk management requirements, driving the demand for sector-specific solutions tailored to address regulatory compliance, cybersecurity threats, and operational risks.

Market Players

- IBM Corporation: A key player in the global risk management software market, IBM offers a comprehensive suite of risk management solutions that leverage advanced analytics, artificial intelligence (AI), and machine learning. The company's offerings help organizations proactively identify and mitigate risks across their operations.

- Oracle Corporation: Oracle provides robust risk management software that enables organizations to assess, monitor, and respond to risks in real-time. The company's solutions integrate with enterprise systems to provide a holistic view of risks and compliance issues, empowering decision-makers with actionable insights.

- SAP SE: SAP is a leading provider of risk management software designed to address the evolving risk landscape faced by businesses today. The company's solutions leverage cutting-edge technologies to predict and prevent potential risks, ensuring proactive risk mitigation strategies.

- Microsoft Corporation: Microsoft offers risk management software that combines powerful analytics capabilities with user-friendly interfaces, allowing organizations to visualize and analyze risk data effectively. The company's solutions help streamline risk assessment processes and improve decision-making.

- ServiceNow, Inc.: ServiceNow specializes in cloud-based risk management software that automates risk assessment workflows and facilitates collaboration among stakeholders. The company's platform enables organizations to centralize risk information and drive continuous improvement in risk management practices.

DDDDDThe global risk management software market is witnessing significant growth propelled by the increasing complexity and volatility of risks faced by organizations across various industries. One emerging trend in the market is the integration of advanced technologies such as artificial intelligence, machine learning, and analytics to enhance risk identification and mitigation processes. Companies are increasingly realizing the importance of proactive risk management strategies to protect their assets, reputation, and overall business continuity. Moreover, the adoption of cloud-based solutions is rising as organizations look to leverage the benefits of scalability, flexibility, and cost-effectiveness offered by cloud platforms.

As the market continues to evolve, customization and specialization in risk management solutions are becoming crucial for catering to the unique requirements of different industry verticals. For instance, the banking, financial services, and insurance (BFSI) sector demand solutions that address regulatory compliance and cybersecurity threats, while the healthcare industry requires tools to manage patient data security and compliance with healthcare regulations. This trend towards industry-specific risk management software is expected to drive further market growth as organizations seek tailored solutions to address their specific risk landscapes.

Another key factor influencing the market dynamics is the increasing emphasis on data security and privacy regulations globally. Data breaches and cyber threats pose significant risks to organizations, prompting them to invest in robust risk management software that can help them safeguard sensitive information and mitigate security vulnerabilities. As regulations such as GDPR and CCPA continue to shape the data protection landscape, companies are under pressure to ensure compliance and mitigate the financial and reputational risks associated with data breaches.

Moreover, the market players mentioned earlier are continuously innovating and expanding their product portfolios to stay competitive in the market. By investing in research and development, strategic partnerships, and mergers and acquisitions, these companies are enhancing their offerings to meet the evolving needs of organizations in the digital age. Additionally, the integration of risk management software with other enterprise systems such as ERP and CRM platforms is enabling organizations to achieve a holistic view of risks and make more informed decisions in real-time.

Overall, the global risk management software market is poised for robust growth driven by the increasing awareness of risk management importance, technological advancements, industry-specific requirements, and regulatory pressures. As organizations strive to navigate the complexities of risks in today's business environment, the demand for innovative and effective risk management solutions is expected to soar, presenting lucrative opportunities for market players to capitalize on this growing trend.The global risk management software market is experiencing a paradigm shift driven by the rapid evolution of risks faced by organizations worldwide. With the increasing complexity and interconnectivity of business operations, organizations are recognizing the critical need for robust risk management solutions to protect their assets, maintain regulatory compliance, and ensure business continuity. This heightened awareness of risk exposure is propelling the demand for advanced risk management software that leverages cutting-edge technologies such as artificial intelligence, machine learning, and analytics to enhance risk identification and mitigation processes.

One of the key trends shaping the market is the growing focus on industry-specific risk management solutions tailored to meet the unique requirements of different sectors. Industries such as banking, financial services, and insurance (BFSI) are seeking solutions that can address regulatory compliance and cybersecurity threats, while healthcare organizations are prioritizing tools that enable them to manage patient data security and comply with stringent healthcare regulations. This trend towards customization and specialization in risk management software is expected to drive market growth as organizations increasingly prioritize targeted risk management solutions that align with their specific risk landscapes.

Furthermore, the market is witnessing a surge in the adoption of cloud-based risk management solutions as organizations seek scalable, flexible, and cost-effective alternatives to traditional on-premises deployments. Cloud platforms offer inherent advantages in terms of accessibility, agility, and scalability, making them increasingly popular among businesses looking to streamline their risk management processes and enhance collaboration among stakeholders. The integration of cloud technology with risk management software is enabling organizations to centralize risk information, automate workflows, and drive continuous improvement in risk management practices.

In addition, the escalating focus on data security and privacy regulations globally is driving organizations to invest in robust risk management software that can help them safeguard sensitive information and mitigate cybersecurity risks. Regulatory frameworks such as GDPR and CCPA are shaping the data protection landscape, compelling companies to prioritize compliance and implement proactive risk mitigation strategies to mitigate the financial and reputational impacts of data breaches. This emphasis on data security and privacy is fueling the demand for innovative risk management solutions that can effectively address evolving cyber threats and regulatory requirements.

Overall, the global risk management software market is poised for significant growth as organizations navigate a dynamic risk landscape characterized by increasing complexity, regulatory pressures, and evolving technology trends. The convergence of advanced technologies, industry-specific requirements, and regulatory challenges is reshaping the risk management software landscape, creating opportunities for market players to innovate, differentiate their offerings, and capitalize on the growing demand for effective risk management solutions in the digital age.

Uncover the company’s portion of market ownership

https://www.databridgemarketresearch.com/reports/global-risk-management-software-market/companies

Structured Market Research Questions for Risk Management Software Market

- What is the present size of the global Risk Management Software industry?

- What annual growth rate is projected for the Risk Management Software sector?

- What are the main segment divisions in the Risk Management Software Market report?

- Who are the established players in the global Risk Management Software Market?

- What geographic areas are explored in the Risk Management Software Market report?

- Who are the leading manufacturers and service providers for Risk Management Software Market?

Browse More Reports:

North America Thermal Paper Market

Asia Pacific Textured Soy Protein Market

Europe Textured Soy Protein Market

Middle East and Africa Textured Soy Protein Market

North America Textured Soy Protein Market

Middle East and Africa Textile Garment Market

Asia-Pacific Textile Films Market

Europe Textile Films Market

Middle East and Africa Textile Films Market

North America Textile Films Market

U.S. Telestroke Market

Europe Tannin Market

North America Tannin Market

U.S. Smart Hospitality Market

Europe Semiconductor Manufacturing Equipment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com