The Europe molded pulp packaging market is emerging as a key segment within the broader sustainable packaging industry. Molded pulp packaging is made from recycled paper, cardboard, or other fibrous materials, offering an eco-friendly alternative to plastics and foams. These packages are commonly used in foodservice, electronics, personal care, and consumer goods sectors due to their ability to provide protection while remaining biodegradable and recyclable. The lightweight yet sturdy nature of molded pulp packaging enables manufacturers to address both operational efficiency and environmental sustainability objectives.

Increasing awareness of environmental issues, coupled with consumer demand for responsible packaging, has made molded pulp packaging an essential component of Europe’s packaging supply chain. Leading companies and retailers are actively seeking alternatives to traditional plastics to comply with regulations and meet sustainability targets. As a result, investments in research and development of molded pulp materials, innovations in structural design, and process automation are becoming more prevalent, further driving the growth of this segment.

According to persistence market research Europe molded pulp packaging market size is expected to be valued at US$1.5 Bn in 2025 and is projected to reach US$2.1 Bn, growing at a CAGR of 4.6% during the forecast period from 2025 to 2032, driven by environmental regulations, circular economy policies, and rising consumer preference for sustainable alternatives to plastics. This forecast highlights the increasing adoption of molded pulp packaging across the region, particularly in applications where sustainability, cost efficiency, and product protection are critical.

Market Size Trends and Growth Outlook

The Europe molded pulp packaging market is witnessing consistent growth supported by several structural and regulatory factors. Environmental regulations targeting single-use plastics and increasing recycling mandates are compelling manufacturers to switch to compostable and recyclable packaging solutions. Food and beverage, electronics, and personal care industries are leading the adoption due to the high demand for protective yet environmentally friendly packaging.

Moreover, the circular economy approach promoted by European Union policies encourages the use of recycled fibers and the development of products designed for recyclability. Molded pulp packaging aligns perfectly with these policies by utilizing post-consumer waste to create durable, biodegradable products. Companies across Europe are increasingly incorporating molded pulp packaging into their sustainability strategies to strengthen brand value and reduce environmental impact.

Key Drivers Supporting Market Expansion

The growth of the Europe molded pulp packaging market is being driven by multiple factors. Rising consumer awareness about the environmental impact of plastics has led to higher demand for compostable alternatives. Molded pulp packaging provides a tangible solution that meets both regulatory and consumer expectations.

Strict environmental regulations play a crucial role in market expansion. Policies such as the European Union’s single-use plastics directive encourage manufacturers and retailers to adopt biodegradable and recyclable alternatives. Molded pulp packaging is an ideal replacement for trays, containers, and protective packaging previously made from foam or plastic.

Another key driver is the increasing adoption in the foodservice and e-commerce sectors. Molded pulp trays, containers, and protective inserts provide adequate cushioning for fragile products while offering environmental credentials. Companies seeking to demonstrate commitment to sustainability are increasingly turning to molded pulp packaging to align with corporate social responsibility initiatives.

Market Segmentation by Material and Product Type

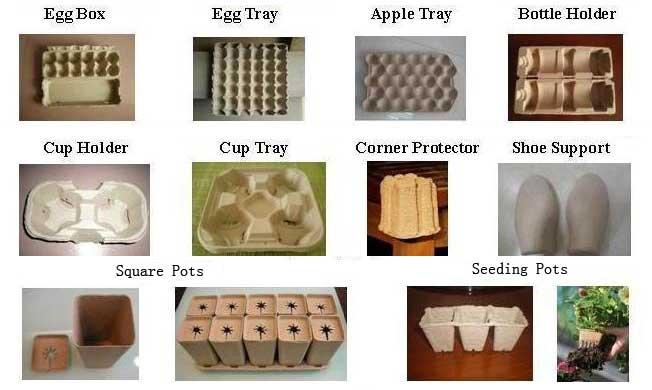

The Europe molded pulp packaging market can be segmented by material and product type. Molded pulp is primarily produced using recycled paper, cardboard, and other fibrous materials. These raw materials are cost-effective, readily available, and can be processed into various packaging formats, including trays, clamshells, inserts, and containers.

Food Trays and Containers: Molded pulp trays and containers are widely used in foodservice and ready-to-eat meals. They provide thermal insulation, prevent product damage, and meet hygiene standards while being fully biodegradable.

Protective Packaging: Protective inserts made from molded pulp are extensively used for electronics, glassware, and delicate consumer goods. These inserts reduce packaging weight, are recyclable, and provide superior impact absorption compared to plastic foam alternatives.

Clamshells and Packaging Shells: Clamshell packaging made from molded pulp is increasingly adopted for bakery products, fruits, and snacks. These packages offer product visibility, ease of handling, and compostability.

Others: Other molded pulp products include egg cartons, beverage carriers, and cosmetic inserts, catering to a diverse set of applications in retail and industrial packaging.

Market Segmentation by End-Use Sector

The Europe molded pulp packaging market serves several end-use sectors.

Food and Beverage: This sector represents the largest share due to the widespread adoption of molded pulp trays, clamshells, and inserts. Consumers increasingly prefer environmentally friendly packaging for fresh produce, bakery items, and ready-to-eat meals.

Electronics: Molded pulp protective packaging is gaining popularity in electronics due to its ability to absorb shock, reduce shipping damage, and replace plastic-based alternatives.

Personal Care and Cosmetics: Molded pulp packaging is being used for premium personal care products and cosmetics, especially in companies promoting sustainability and zero waste packaging.

E-commerce and Retail: The rapid growth of online retail has led to increased demand for molded pulp protective packaging to safely transport products while minimizing environmental impact.

Regional Insights and Leading Countries

Europe’s molded pulp packaging market is primarily driven by Western European countries such as Germany, France, and the United Kingdom. These countries are leading in adoption due to stricter environmental policies, higher consumer awareness, and strong retail and e-commerce sectors.

Eastern Europe is also witnessing gradual growth as manufacturers adopt recycled packaging solutions to align with EU regulations and sustainability initiatives. Northern European countries such as Sweden and Denmark are notable for early adoption of sustainable packaging technologies and significant investments in circular economy initiatives.

The regional growth is also supported by government incentives for recycling, industrial investments in pulp processing, and technological advancements in molded pulp production, allowing for higher efficiency and improved product design.

Market Drivers in Paragraph Format

Several drivers contribute to the positive growth outlook of the Europe molded pulp packaging market. Rising environmental consciousness among consumers has led to increasing demand for recyclable, biodegradable, and compostable packaging. Regulatory frameworks in Europe, including bans on certain single-use plastics, push manufacturers toward sustainable alternatives. Furthermore, the adoption of molded pulp packaging in high-volume sectors such as foodservice, retail, and electronics ensures steady demand. Industrial investments in automated production lines and innovative molding technologies enhance efficiency, reduce cost, and expand the product portfolio, further accelerating market growth.

Market Restraints in Paragraph Format

Despite its growth, the Europe molded pulp packaging market faces challenges. Molded pulp packaging may have limitations in terms of water resistance, printability, and aesthetic appeal compared to plastics. Manufacturers need to apply coatings or treatments to improve performance, which can increase costs. Price sensitivity in certain end-use sectors may also restrict adoption, particularly where low-cost plastic alternatives are still prevalent. Additionally, fluctuations in the supply of recycled paper and pulp can affect production stability and market pricing.

Market Opportunities in Paragraph Format

The Europe molded pulp packaging market presents numerous opportunities. Growth in e-commerce, ready-to-eat meals, and sustainable product lines offers new applications for molded pulp packaging. Investment in technological innovations such as high-quality surface finishing, water-resistant coatings, and complex structural molding can expand its usability. Additionally, increasing corporate sustainability initiatives provide opportunities for manufacturers to partner with global brands seeking eco-friendly packaging solutions. Expansion into emerging European markets can also provide significant growth potential as demand for sustainable alternatives continues to rise.

Key Players in the Europe Molded Pulp Packaging Market

The market comprises a mix of established packaging companies and regional players focusing on sustainability. Leading companies emphasize technological innovation, capacity expansion, and sustainable material usage to maintain competitiveness.

- Flatz GmbH

- Pulp-Tec Limited

- TART Packaging Solutions GmbH

- PAPACKS SALES GmbH

- Otarapack Packaging Solutions

- Huhtamaki Oyj

- Omni-Pac Group

- MM Group

- PackTech Global Solutions

- EcoMold Pulp Packaging

- James Cropper PLC

- buhl-paperform GmbH

These players are investing in research and development to improve molded pulp product quality, enhance water resistance and develop innovative packaging solutions for diverse end-use industries. Strategic partnerships with food, electronics, and cosmetic brands are also expanding market penetration.

Conclusion

The Europe molded pulp packaging market is poised for steady growth, driven by environmental regulations, circular economy policies, and growing consumer preference for sustainable packaging solutions. With a projected market value of US$2.1 Bn by 2032 and a CAGR of 4.6 percent, opportunities abound in foodservice, e-commerce, electronics, and personal care sectors. Continued innovation in material processing, automation, and product design will further strengthen the market, making molded pulp packaging a key component of Europe’s sustainable packaging ecosystem.