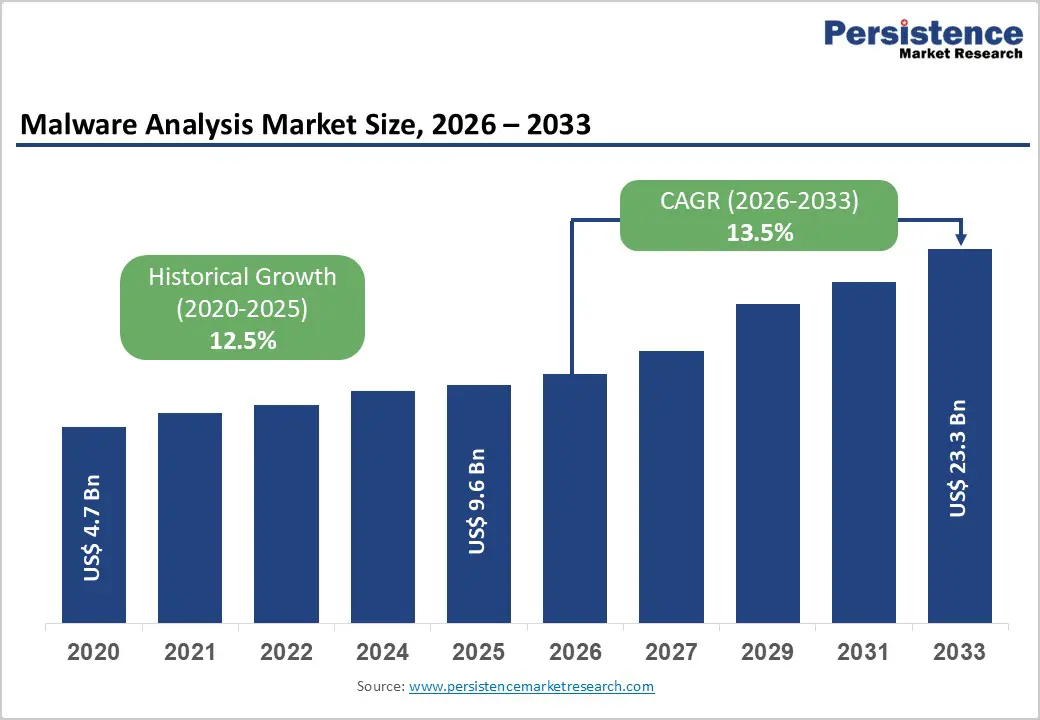

The malware analysis market is experiencing unprecedented growth, fueled by the increasing sophistication of cyber threats, ransomware attacks, and the rapid evolution of malware designed to bypass conventional defenses. With the global market expected to reach US$ 23.3 billion by 2033 from US$ 9.6 billion in 2026, registering a CAGR of 13.5%, enterprises and governments alike are investing heavily in advanced malware detection and analysis solutions to safeguard their digital ecosystems.

Malware analysis, at its core, involves the process of studying, dissecting, and understanding malicious software to uncover its origin, purpose, and mode of attack. This knowledge equips organizations to not only defend against known malware but also detect zero-day exploits, advanced persistent threats (APTs), and behavioral anomalies that traditional signature-based antivirus solutions cannot identify.

Rising Threat Landscape: Driving Market Growth

The surge in malware-related incidents is a primary driver of market expansion. Organizations are facing unprecedented cyberattack frequencies, with over 3,000 attacks recorded weekly in India alone, and global ransomware incidents rising 36% year-over-year through 2025. This escalation underscores the critical need for robust malware analysis capabilities.

Several factors are accelerating the complexity and volume of malware attacks:

- Polymorphic and Metamorphic Malware: Modern malware can change its code structure or behavior dynamically to evade detection. Traditional antivirus tools struggle against these adaptive threats, increasing the demand for advanced analysis solutions.

- Ransomware Proliferation: Ransomware attacks have evolved beyond simple data encryption, often including data theft, double extortion, and targeting critical infrastructure. This compels organizations to integrate comprehensive malware analysis into their cybersecurity strategies.

- Cloud and IoT Vulnerabilities: As organizations move operations to the cloud and deploy Internet of Things (IoT) devices, the attack surface expands exponentially. Malware can exploit these endpoints to launch sophisticated attacks, driving demand for cloud-based malware analysis solutions.

AI and Machine Learning: Revolutionizing Malware Detection

A pivotal trend in malware analysis is the integration of artificial intelligence (AI) and machine learning (ML). Traditional malware detection relies on signature-based systems that identify threats by comparing them to known malware signatures. However, AI-powered analysis platforms can detect anomalies, predict attack patterns, and identify previously unknown threats in real time.

Key capabilities enabled by AI and ML include:

- Behavioral Analysis: Monitoring software behavior in isolated environments to detect malicious actions.

- Zero-Day Threat Detection: Recognizing previously unseen vulnerabilities exploited by attackers.

- Automated Threat Intelligence: Continuously updating threat databases with emerging malware patterns.

These capabilities are crucial as enterprises face highly targeted attacks aimed at stealing sensitive data, disrupting operations, or compromising critical systems.

Market Segmentation: Solutions vs. Services

The malware analysis market can be broadly segmented into solutions and services.

Solutions Segment: Market Leader

The solutions segment holds a dominant 68% market share in 2025, driven by the adoption of advanced malware analysis tools. Organizations are increasingly investing in:

- Static Analysis Tools: Examining code without executing it to identify malicious patterns.

- Dynamic Analysis Tools: Running malware in a controlled environment to observe behavior and uncover hidden functionalities.

- Hybrid AI-Based Solutions: Combining static and dynamic analysis with AI algorithms for predictive detection.

This trend is particularly evident among large enterprises in sectors like finance, healthcare, and government, where data integrity and security are paramount.

Services Segment: Managed Malware Analysis

Managed security services, including threat monitoring, incident response, and malware forensics, are gaining traction. These services allow organizations to leverage expert knowledge and reduce operational burden while maintaining strong defenses against advanced threats.

Deployment Models: On-Premises vs. Cloud

The deployment of malware analysis platforms significantly impacts market growth. While on-premises solutions remain popular due to stringent data control requirements, cloud-based deployments are emerging as the fastest-growing segment with a CAGR of 15.8% through 2032.

Cloud-based malware analysis offers multiple advantages:

- Scalability: Resources can be dynamically adjusted based on demand.

- Real-Time Threat Intelligence: Immediate updates from global threat intelligence networks improve detection accuracy.

- Cost-Effectiveness: Subscription-based models reduce upfront investment and maintenance costs.

As organizations increasingly adopt hybrid IT environments, cloud deployments are becoming indispensable for proactive cybersecurity.

Regional Insights: North America and Asia Pacific

North America: Market Leader

North America holds the largest market share at 42%, supported by several factors:

- High Cybersecurity Spending: Organizations invest significantly in tools and services to protect critical assets.

- Strong Vendor Presence: Leading cybersecurity solution providers are headquartered in the region, offering advanced malware analysis tools.

- Regulatory Compliance: Stringent regulations such as HIPAA, SOX, and GDPR drive enterprises to adopt robust malware defense mechanisms.

Asia Pacific: Fastest Growing Region

Asia Pacific is projected to be the fastest-growing region, with a CAGR of 16.8% through 2032. Growth is fueled by:

- Rapid Digitalization: Increasing adoption of digital platforms across industries.

- Cloud Adoption: Accelerated migration to cloud environments exposes organizations to new cyber threats.

- Rising Cyberattacks: High-frequency attacks compel enterprises to invest in comprehensive malware analysis solutions.

Countries like India, China, and Japan are leading the regional surge, offering significant market opportunities for vendors.

Key Opportunities: Advanced Persistent Threat (APT) Detection

One of the most promising areas in malware analysis is APT detection, particularly in government and defense sectors. APTs are sophisticated, prolonged attacks often backed by nation-state actors. They target sensitive information, infrastructure, and critical systems.

Investments in APT-focused malware analysis solutions are increasing due to:

- Complex Threat Landscapes: Highly skilled adversaries employ stealth techniques that evade traditional defenses.

- High-Value Targets: Government agencies, defense contractors, and critical infrastructure operators require specialized malware detection and mitigation tools.

- Regulatory Compliance: National cybersecurity directives mandate robust protection against advanced threats.

Emerging Trends Shaping the Market

The malware analysis market is evolving rapidly, with several key trends shaping its future trajectory:

- Integration with Threat Intelligence Platforms: Combining malware analysis with threat intelligence enhances detection accuracy and enables predictive defense strategies.

- Behavioral Analytics and UEBA: User and entity behavior analytics (UEBA) is increasingly integrated with malware analysis to detect insider threats and anomalous activities.

- Automated Malware Forensics: Automation reduces the time required to analyze complex malware, helping security teams respond faster.

- Cross-Platform Malware Detection: With organizations using multiple operating systems and devices, cross-platform malware analysis is gaining importance.

- Regulatory Alignment: Compliance with regulations like GDPR, CCPA, and NIS2 drives investment in advanced malware detection and reporting capabilities.

Challenges in the Malware Analysis Market

Despite strong growth prospects, the malware analysis market faces several challenges:

- Rapid Malware Evolution: Constant changes in malware code and attack strategies make detection increasingly difficult.

- Skills Shortage: There is a global shortage of skilled cybersecurity professionals capable of analyzing complex malware threats.

- Integration Complexity: Organizations struggle to integrate malware analysis tools with existing security infrastructure.

- Cost Constraints: Advanced solutions, particularly AI-based platforms, require significant investment, which may be prohibitive for small and medium enterprises.

Vendors are addressing these challenges by offering cloud-based SaaS solutions, managed services, and AI-driven automation, making malware analysis more accessible and effective.

Competitive Landscape: Key Players and Strategies

The malware analysis market is highly competitive, with leading vendors focusing on innovation, partnerships, and strategic acquisitions to expand their market presence. Key strategies include:

- R&D Investment: Developing AI-based analysis engines, behavioral monitoring tools, and automated forensic platforms.

- Partnerships with Managed Security Service Providers (MSSPs): Extending reach through outsourced cybersecurity services.

- Geographical Expansion: Targeting high-growth regions such as Asia Pacific, Middle East, and Africa.

- Focus on Niche Solutions: Specialized tools for APT detection, cloud security, and ransomware mitigation.

Top vendors are not only providing products but also offering end-to-end cybersecurity ecosystems that integrate malware analysis with incident response, threat intelligence, and compliance management.

Future Outlook and Market Forecast

The global malware analysis market is poised for robust growth over the forecast period. Key factors contributing to market expansion include:

- Escalating Cyber Threats: As digital transformation accelerates, organizations face more sophisticated attacks, driving demand for advanced malware detection.

- Adoption of AI and Machine Learning: Intelligent malware analysis platforms will dominate as enterprises seek proactive defense mechanisms.

- Cloud and Hybrid Deployments: Scalable, subscription-based models offer flexibility and real-time protection, accelerating adoption.

- Regulatory Pressures: Compliance with data protection laws and cybersecurity mandates compels organizations to invest in comprehensive malware analysis solutions.

By 2033, the market is projected to reach US$ 23.3 billion, with North America maintaining leadership, Asia Pacific emerging as the fastest-growing region, and cloud-based deployment becoming mainstream.

Conclusion

The malware analysis market is entering a phase of accelerated growth, driven by evolving cyber threats, regulatory mandates, and technological innovation. Organizations across industries are prioritizing malware analysis as a critical component of their cybersecurity strategy.

With AI and machine learning redefining detection capabilities, cloud deployments enhancing scalability, and APT detection creating niche opportunities, the market presents significant prospects for vendors and enterprises alike. Businesses that invest in comprehensive malware analysis platforms and managed services will not only protect their digital assets but also gain a strategic advantage in an increasingly hostile cyber environment.

As cyber threats continue to evolve in complexity and frequency, malware analysis is no longer optional—it is an essential pillar of enterprise cybersecurity. With projected growth at a CAGR of 13.5%, the market is poised to transform the cybersecurity landscape, offering robust solutions to combat today’s and tomorrow’s threats.

Related Reports: