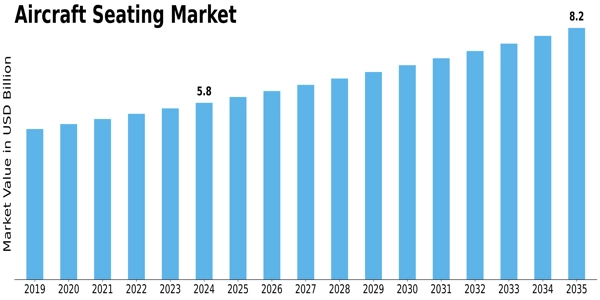

As airline cabins evolve from functional transport spaces into branded customer-experience zones, the aircraft seating market is receiving renewed attention. Recent figures estimate this market at around USD 5.57 billion in 2023, with a projected rise to approximately USD 8.2 billion by 2035—a CAGR of roughly 3.26%.

Industry Overview

Beyond mere seating, this market reflects the interplay between passenger expectations, airline economics and aircraft engineering. Seat-manufacturers must integrate structural safety, ergonomics, materials technology and cabin-layout constraints, all while satisfying certification regimes and cost-targets. Airlines increasingly view seats as not just cost centres but as differentiators—especially in premium economy or business class configurations. Moreover, retrofit demand and cabin reconfigurations add to new aircraft orders in driving seating demand.

Market Outlook

Over the next decade, the aircraft seating segment is slated for stable growth. Drivers include: expanding airline networks, rising passenger numbers, growth of low-cost carriers, increased demand for premium seating categories and a heightened focus on sustainability (lighter seats lead to fuel savings). The competition among manufacturers centres on material innovation (composites, lightweight metals), modular seat architectures and advanced features. Although growth is moderate, the market holds strategic value for aerospace suppliers and investors alike.

Key Players’ Role

In a fragmented yet competitive market, certain firms stand out. Sichuan Tengdun has established a strong footprint with economy-to-first-class offerings and global partnerships. Universal Aviation Seating emphasises premium customisation and integration with private and commercial aircraft. Recaro Aircraft Seating, Zodiac Aerospace and Thompson Aero Seating bring global scale, deep R&D investments and alignment with major airlines and airframers. These companies are leveraging acquisitions, co-development deals and material-innovation initiatives to maintain leadership and respond to shifting airline demands.

Segmentation Growth

Important segmentation features include:

-

Seat Type: Economy class remains the largest segment by value due to volume; predicted to grow from USD 2.88 billion (2024) to ~USD 4.05 billion (2035). Premium economy, business and first class are also evolving as airlines refine their cabin offerings.

-

Material: Leather (luxury/cabin premium), fabric (cost-effective comfort), plastic and metal (lightweight and structural integrity) form the key material categories. Lightweight plastics and alloys are gaining traction for weight-savings.

-

Aircraft Type / End-User: Demand from narrow-body aircraft dominates owing to their large numbers; wide-body and regional jets represent additional niches. End-users: commercial airlines are the primary buyers, while private and military aviation add further layers of demand.

-

Region: North America leads with an estimated USD 2.25 billion in 2024; Europe (~USD 1.7 billion) and Asia-Pacific (~USD 1.5 billion) follow. Emerging regions such as Latin America and Middle East & Africa, though smaller in 2024, show potential for accelerated growth.

Summary

The aircraft seating market may not be headline-making, but for industry insiders, it is meaningful. Airlines seeking to deliver compelling cabin experiences, and seat-suppliers oriented to material innovation and modular design, will find this segment ripe for strategic investment. Alignment with sustainability goals, lightweight engineering and passenger-comfort enhancements will likely dictate market winners in the coming years.