As global drone adoption expands across logistics, security operations, inspection services, and emergency response, regulators are under pressure to ensure safe and structured airspace usage. Without defined rules and coordinated flight paths, drone activity can easily interfere with manned aviation, critical facilities, or other unmanned aircraft. This growing operational complexity is accelerating the development of digital infrastructure to support orderly drone integration.

The rising Unmanned Traffic Management Market is heavily influenced by the demand for airspace integration for commercial drones. Commercial operators require predictable routing, automated authorization, and real-time monitoring to sustain large-scale deployments. As delivery drones, mapping fleets, and inspection units multiply, airspace integration becomes essential to minimize collision risks and ensure operational continuity.

Commercial drones frequently operate near populated areas, industrial sites, and transportation corridors. Effective integration frameworks help manage altitude layers, assign flight corridors, and manage dynamic airspace restrictions. This ensures that drones can navigate safely even in environments where multiple operators share the same airspace. It also reduces the chances of accidental intrusions into restricted or sensitive zones.

Integrated airspace solutions rely heavily on digital identification, flight tracking, and automated coordination. These systems allow regulators to maintain situational awareness and enforce compliance through live telemetry. In addition, integrated airspace solutions reduce the administrative burden for operators by automating flight approvals and providing machine-readable guidance. Such automation is crucial as drone operations scale beyond pilot testing.

Weather data, emergency alerts, infrastructure proximity, and temporary flight restrictions all influence safe drone operations. Airspace integration frameworks incorporate these data points, enabling dynamic routing and contingency plans. This proactive approach reduces the likelihood of accidents and improves the reliability of commercial drone missions.

As governments strengthen their drone regulations, the demand for standardized digital infrastructure grows. Many regions are adopting performance-driven rules that require commercial operators to comply with automated identification, location broadcasting, and operational transparency. Airspace integration platforms help enforce these rules while reducing barriers to commercial deployment.

With continuous advancements in AI-based flight prediction, autonomous routing, and cloud-connected traffic systems, airspace integration will become more intelligent and adaptive. As commercial drone usage accelerates, integrated UTM infrastructure is poised to become a central pillar of the global drone ecosystem.

Top Leading Key Players

Leonardo S.P.A. (Italy), Frequentis (Austria), Altitude Angel (UK), L3Harris Technologies Inc. (US), Skyward (US), Lockheed Martin Corporation (US), AirMap Inc. (US), Nova Systems (Australia), Thales Group (France), and Unifly (Belgium).

Table of Contents

SECTION I: EXECUTIVE SUMMARY AND KEY HIGHLIGHTS

SECTION II: SCOPING, METHODOLOGY AND MARKET STRUCTURE

SECTION III: QUALITATIVE ANALYSIS

SECTION IV: QUANTITATIVE ANALYSIS

SECTION V: COMPETITIVE ANALYSIS ........

FAQs

How much is the Unmanned Traffic Management (UTM) Market?

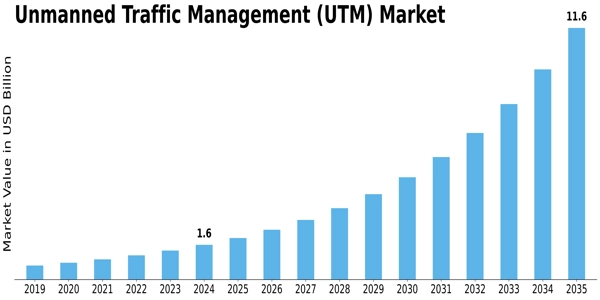

The Unmanned Traffic Management (UTM) Market size was valued at USD 1.35 Billion in 2023.

Which Solution led the Unmanned Traffic Management (UTM) Market?

The Communication Infrastructure category dominated the market in 2023.

Which Type had the largest market share in the Unmanned Traffic Management (UTM) Market?

The Persistent had the largest share in the market.

Related Report: