The 3D printing metal market has emerged as one of the most transformative segments within the advanced manufacturing landscape. Metal additive manufacturing enables the creation of complex and high performance components through layer by layer fabrication using metal powders or wires. Unlike conventional subtractive manufacturing processes this technology allows manufacturers to achieve intricate geometries reduced material waste and faster production cycles.

The growing need for design flexibility lightweight structures and rapid prototyping has accelerated the adoption of metal based additive manufacturing across multiple industries. Aerospace automotive healthcare and industrial manufacturing sectors are increasingly integrating metal 3D printing into their production workflows. As industries move toward digital manufacturing and smart factories metal additive manufacturing is becoming a strategic capability rather than a niche innovation.

With continuous advancements in materials software and printing technologies the 3D printing metal market is transitioning from prototyping applications to full scale production. This shift is redefining traditional manufacturing economics and opening new opportunities for customization performance optimization and supply chain efficiency.

Market Size and Growth Outlook

The global 3D printing metal market size was valued at US$ 1.2 billion in 2025 and is projected to reach US$ 4.2 billion by 2032 growing at a CAGR of 19.8% between 2025 and 2032.

This rapid growth reflects the increasing commercial viability of metal additive manufacturing technologies and their expanding role in mission critical applications. High growth rates are supported by rising investments in research and development expanding industrial adoption and strong demand for lightweight and high strength components.

The forecast period highlights a transition phase where metal 3D printing moves beyond early adoption into broader industrial utilization. As costs decline and production reliability improves manufacturers are expected to scale deployment across a wider range of applications.

Key Drivers Accelerating Market Growth

Several powerful drivers are shaping the growth trajectory of the 3D printing metal market. One of the most influential factors is the aerospace and defense industry demand for lightweight high performance components. Aircraft and defense platforms require parts that combine strength durability and weight reduction which metal additive manufacturing delivers effectively.

The healthcare sector represents another major growth driver. Increasing demand for customized medical implants prosthetics and surgical tools has created strong opportunities for metal 3D printing. The ability to produce patient specific implants with precise geometries enhances clinical outcomes and reduces recovery times.

Industrial manufacturing is also contributing to market expansion. Companies are adopting metal additive manufacturing to reduce lead times optimize part designs and lower inventory costs. On demand production and digital inventory models are gaining traction as supply chain resilience becomes a strategic priority.

Role of Metal Additive Manufacturing in Modern Production

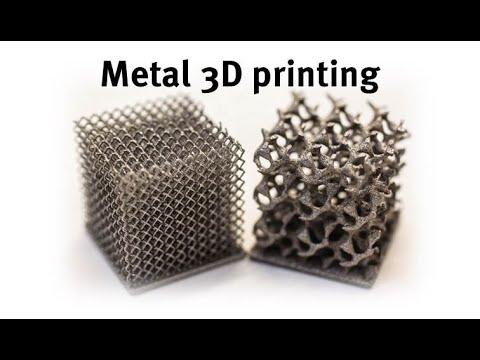

Metal additive manufacturing plays a critical role in modern production environments by enabling new design possibilities and operational efficiencies. Traditional manufacturing methods often impose limitations on part geometry due to tooling and machining constraints. Metal 3D printing removes many of these barriers allowing engineers to design components optimized for performance rather than manufacturability.

This technology supports internal channels lattice structures and topology optimized designs that improve strength to weight ratios and thermal performance. As a result manufacturers can achieve higher functionality with fewer parts which simplifies assembly and reduces overall system complexity.

Metal 3D printing also enhances production agility. Rapid design iteration and shorter development cycles allow companies to respond quickly to market demands and technological changes. This flexibility is particularly valuable in industries with fast innovation cycles and customized product requirements.

Technology Segmentation and Process Types

The 3D printing metal market encompasses several additive manufacturing technologies each suited to specific applications and performance needs. Powder bed fusion is one of the most widely used processes offering high precision and excellent mechanical properties. It is commonly used in aerospace medical and industrial applications.

Directed energy deposition is another important technology enabling the repair and modification of existing components as well as the production of large scale parts. This process is valued for its flexibility and ability to work with multiple materials.

Binder jetting technology is gaining attention for its potential to support high volume production. By enabling faster printing speeds and scalability binder jetting is well suited for applications requiring cost effective manufacturing of complex metal parts.

Each technology contributes to the overall market by addressing different use cases production scales and material requirements.

Materials Landscape and Metal Powder Demand

Material innovation is a cornerstone of growth in the 3D printing metal market. Commonly used metals include titanium aluminum stainless steel nickel alloys and cobalt chromium. These materials are selected based on application specific requirements such as strength corrosion resistance and biocompatibility.

Titanium alloys are widely used in aerospace and medical applications due to their high strength to weight ratio and excellent biocompatibility. Aluminum alloys are preferred for automotive and consumer electronics applications where lightweight and thermal performance are critical.

The growing demand for high quality metal powders has led to increased investment in powder production technologies. Consistency particle size distribution and purity are essential factors influencing print quality and mechanical performance. As material science advances the range of printable metals continues to expand supporting broader adoption.

End Use Industry Applications

The aerospace and defense sector remains the largest adopter of metal 3D printing technology. Applications include structural components engine parts and complex assemblies that benefit from weight reduction and performance optimization. Metal additive manufacturing supports both prototyping and production of flight critical components.

Healthcare applications are rapidly expanding particularly in orthopedics and dental implants. Customized implants surgical guides and prosthetics are produced with high precision improving patient outcomes and reducing manufacturing lead times.

Automotive manufacturers are increasingly exploring metal 3D printing for tooling prototyping and low volume production. As electric vehicles and lightweight designs gain importance additive manufacturing offers new design and production opportunities.

Industrial machinery energy and electronics sectors also represent growing application areas as companies seek durable high performance parts with shorter development cycles.

Regional Market Analysis

The 3D printing metal market exhibits strong regional growth patterns influenced by technological readiness and industrial investment.

· North America leads the market due to early adoption strong research infrastructure and significant aerospace and defense spending. The United States remains a hub for innovation and commercialization of metal additive manufacturing technologies.

· Europe follows closely with strong demand from automotive aerospace and healthcare industries. Countries such as Germany France and the United Kingdom are investing heavily in advanced manufacturing and digitalization initiatives that support market growth.

· Asia Pacific is emerging as a high growth region driven by rapid industrialization and expanding manufacturing capabilities. China Japan and South Korea are increasing investments in additive manufacturing to enhance production efficiency and technological competitiveness.

Other regions including the Middle East and Latin America are gradually adopting metal 3D printing as industrial modernization progresses.

Competitive Landscape and Market Structure

The global 3D printing metal market is characterized by a dynamic competitive landscape with technology providers material suppliers and service bureaus playing key roles. Companies compete on factors such as print quality speed material compatibility and software integration.

Leading players invest significantly in research and development to enhance printer capabilities and expand material offerings. Strategic partnerships acquisitions and collaborations are common as companies seek to strengthen their market position and address evolving customer needs.

Service providers offering design optimization printing and post processing services are gaining importance particularly for small and medium enterprises that lack in house additive manufacturing capabilities.

Sustainability and Supply Chain Impact

Metal 3D printing supports sustainability goals by reducing material waste and enabling localized production. Traditional manufacturing processes often generate significant scrap while additive manufacturing uses material more efficiently by building parts only where needed.

Localized production reduces transportation emissions and enhances supply chain resilience. Digital designs can be transmitted globally and printed locally reducing dependency on centralized manufacturing facilities.

Sustainability considerations are becoming increasingly important as industries seek to reduce environmental impact while maintaining performance and quality standards.

Future Trends and Market Opportunities

The future of the 3D printing metal market is shaped by continuous technological advancement and expanding industrial adoption. Automation integration and artificial intelligence driven process optimization are expected to enhance production reliability and scalability.

The development of multi material printing and hybrid manufacturing systems will open new application possibilities. As certification standards mature metal additive manufacturing will gain greater acceptance in regulated industries.

Emerging applications in energy infrastructure space exploration and advanced electronics present significant growth opportunities. As costs decline and capabilities improve metal 3D printing is expected to become an integral part of mainstream manufacturing.

Conclusion

The global 3D printing metal market is undergoing rapid transformation driven by technological innovation and expanding industrial demand. With the market projected to grow from US$ 1.2 billion in 2025 to US$ 4.2 billion by 2032 the outlook remains highly positive.

Aerospace defense and healthcare applications continue to lead adoption while automotive and industrial sectors are accelerating integration. Regional expansion material innovation and sustainability benefits are shaping long term market dynamics. As industries prioritize performance customization and digital manufacturing metal additive manufacturing will play a central role in the future of global production systems